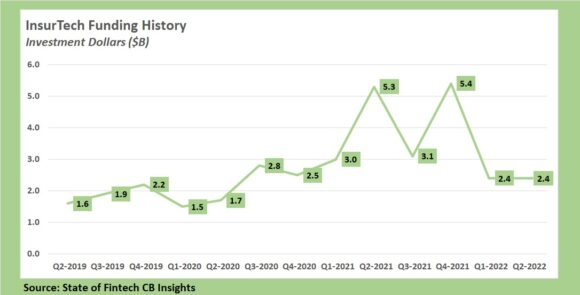

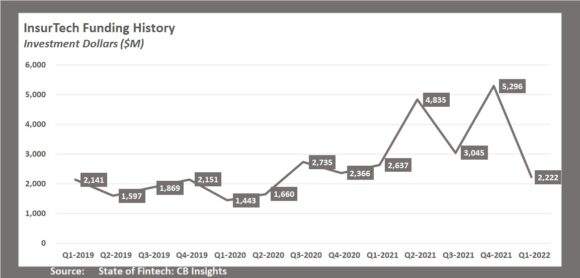

According to data released by CB Insights last week, financing for the insurtech industry remained stable in the second quarter of 2022, coming in at around $2.4 billion, the same as the total funding number recorded for the first quarter of 2022.

After a significant decline in the first quarter, the cash amount has been stable quarter over quarter. The $2.4 billion funding total is less than half of the $5.4 billion insurtech funding total that CB Insights reported for the fourth quarter of 2021.

When compared to Insurtech financing for the same period the year before ($5.3 billion for second-quarter 2021), the $2.4 billion second-quarter 2022 funding figure exhibits a comparable decline.

The total amount of insurtech funding last year was $16.8 billion, with record-breaking numbers for each of the four quarters, according to the findings in CB Insights’ report released last week. Accordingly, the $4.8 billion in funds committed so far for 2022 represents barely 29% of the total deal value for the previous year.

In the second quarter of 2022, there were 131 deals, which is a decrease of 26% from the second quarter of 2021 and a reduction of 17% from the first quarter’s 157 deals.

Deal numbers for the entire year 2022 could catch up to last year’s total of 640 with a strong third and fourth quarter, but funding dollars appear more on track to mirror levels attained in 2019 and 2020 (ranging from $7.9 billion to $8.5 billion).

The information was made available online by CB Insights in its 197-page “State of Fintech Q2’22 Report,” which showed that global fintech funding overall—including funding for insurtech, banking tech, digital lending, wealth tech, and capital markets tech—fell to $20.4 billion in the second quarter of 2022—down 33% from the first quarter of 2021 and down 46% from the second quarter of 2021. Similar to insurtech alone, there were 1,225 global fintech agreements in the first quarter of 2022, a 17 percent decrease from the previous quarter.

According to CB Insights, investment levels and transaction counts for fintech as a whole fell to their lowest quarterly totals since the fourth quarter of 2020.

The average insurtech deal size so far in 2022 is $20 million, down from the average deal size of $32 million across all four quarters of 2021.

The $20 million is consistent with the $20 million and $21 million average deal sizes for insurtechs that CB Insights estimated for 2019 and 2020.

The number of M&A exits appears to be ahead of last year’s pace, with 46 planned for 2022, as shown in CB Insights’ first-quarter report. 58 were recorded for the entire previous year.

As part of its study, CB Insights keeps track of the geographic distribution of insurtech deals, the proportion of early-stage versus late-stage agreements, unicorn births by quarter, IPOs, and SPACs. The $200 million Series D fundraising round for Newfront Insurance, an insurtech brokerage platform, is included as the top equity deal in the report’s top 10 list of deals for the quarter.

0 Comments