For an undisclosed sum, Umba, a US-based digital bank with a focus on emerging countries, purchased the majority of shares in Daraja, a Kenyan deposit-taking microfinance bank.

The acquisition of Umba’s 66.6 percent stake, according to Kenya’s central bank, the Central Bank of Kenya (CBK), is anticipated to hasten Daraja’s digitization.

This comes after Umba reported in April of this year that it had raised $15 million in a pre-series A financing, along with intentions to grow outside of Nigeria to Kenya, Ghana, and Egypt. Tom Blomfield, the co-founder of Monzo, Lachy Groom and ACT Ventures, Lux Capital, Palm Drive Capital, Banana Capital and Streamlined Ventures, as well as Costanoa Ventures, have all invested in Umba to date, raising a total of $17.5 million.

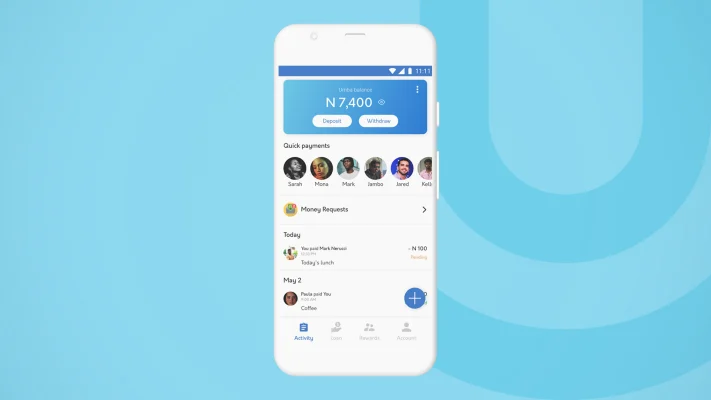

Tiernan Kennedy and Barry O’Mahony launched the fintech, which provides a variety of financial services, including bill payment, free accounts, peer-to-peer transfers, interbank transfers, and loans with a 10% monthly interest rate.

“Daraja MFB’s business model will be strengthened by the UMBA investment. It will boost Daraja MFB’s digitization in particular as it transitions to offering “anytime, everywhere” services to its clients. This is in line with the CBK’s goal of creating a microfinance banking industry that serves Kenya and the country, the CBK stated in a statement.

According to the CBK, Daraja, which received its license in 2015 and mostly serves small and medium-sized businesses, has a market share of less than 1% of Kenya’s microfinance banking industry.

Daraja will give Umba a better position in the competitive financial market of the nation and the chance to provide more focused services. It will also provide a lifeline for microfinance in a market that has been severely disrupted by online lenders.

A few months prior to its agreement with Daraja, Branch International, another Silicon Valley-based fintech with operations throughout Africa, acquired the bulk of the stock in Century Microfinance Bank.

Fintechs can now offer additional banking services that they would otherwise not be able to support thanks to these acquisitions, which also allow them access to the current financial services customer.

0 Comments